Hello, I’m Rowan …

I live in Aotearoa New Zealand.

I am the chairman of Hoku Group, our family office, which combines our private investments, early-stage venture investments and Hoku Foundation, our non-profit foundation.

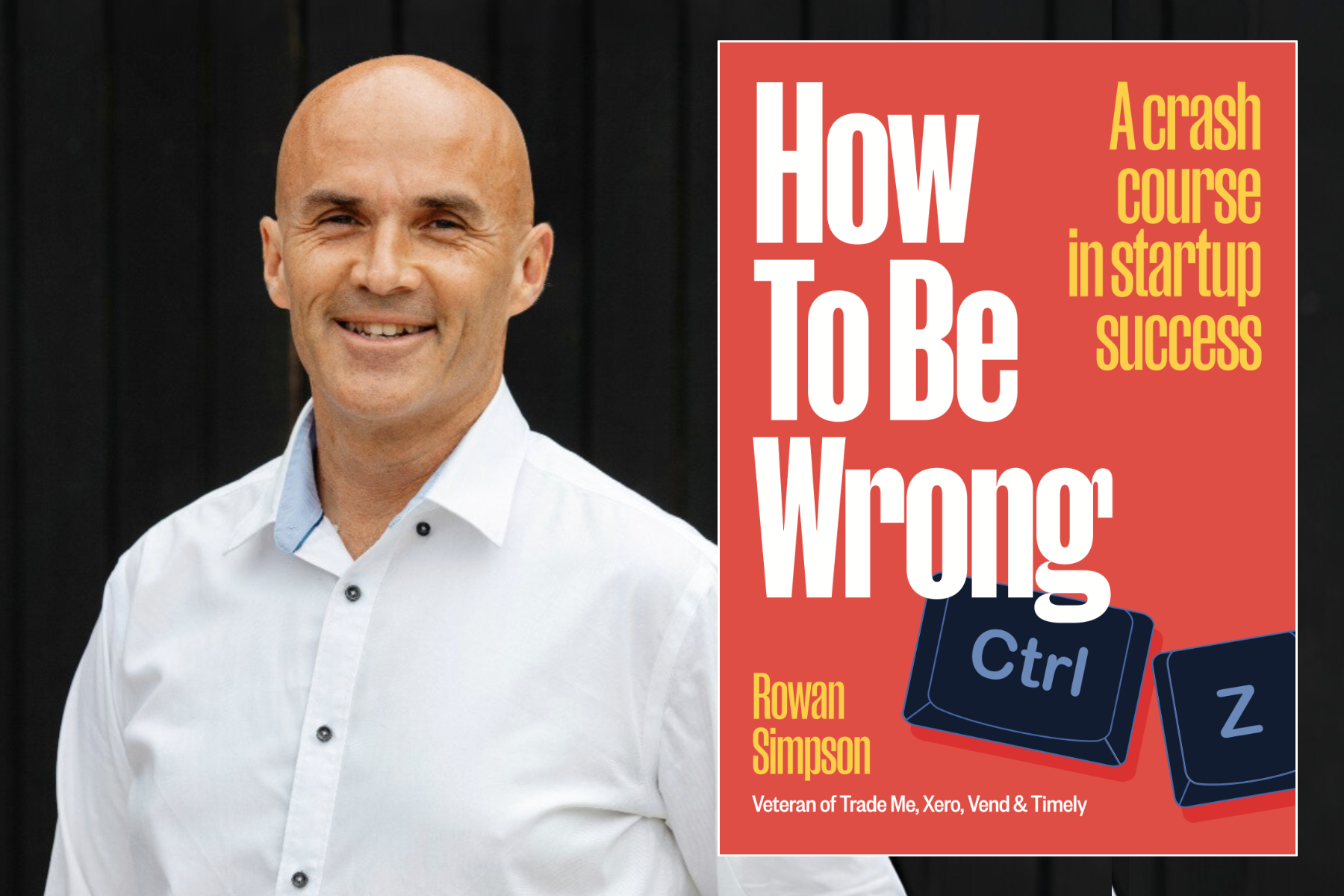

I am the author of the book How to be Wrong: a crash course in startup success, published in February 2025. Buy now.

I am a founder of and early investor in multiple high-growth technology businesses.

In 2013 I was the first investor in Timely. I was as an advisor and director through to the sale to EverCommerce for ~$US100m in 2021.

In 2010 I was one of the initial investors in Vend. I was the chairman of the board of directors until 2015. Vend was acquired by Lightspeed for ~US$350m in 2021.

In 2007 I was a pre-IPO investor in Xero, and worked as part of the original executive team at time the business was listed on the NZX. Xero is now one of the most successful businesses ever started in New Zealand, with millions of global subscribers.

In 2000 I was employee #3 at Trade Me. I led the software development team as the business grew rapidly to become an iconic Kiwi brand, including through the sale to Fairfax for $750m in 2006.

Active startup investments include Tractor Ventures, Melodics, Lightyears Solar, Atomic, Parkable, StickyBeak Firmcheck and Thematic.

I hold a Bachelor of Science degree in Computer Science from Victoria University of Wellington.

Selected Media

- Why Govt shouldn’t be picking start-up winners, Q+A, TVNZ, 2025

- How to be Wrong: a crash course in startup success, Sunday Morning, Radio New Zealand, 2025

- “No shortage of capital”: How to build successful businesses in NZ?, Mike Hosking Breakfast, NewstalkZB, 2025

- Startups, being wrong, and near-death experiences, BusinessDesk, 2025

- Is AI having its lightbulb moment?, NZ Herald, 2025

- Scrapping Callaghan Innovation is a necessary reset. But what comes next?, The Spinoff, 2025

- In conversation with Joel Little, Sunrise Festival, 2024

- Keynote: If technology is the answer, what is the question?, Sport NZ Connections Conference, 2024

- High Flyers Podcast with Vidit Agarwal, 2022

- Hard Mode Podcast with Matt Allen: Technology & People, Tractor Ventures, 2021

- When The Facts Change Podcast with Bernard Hickey: What we’ve learned about working from home, The Spinoff, 2021

- The Halo Effect, AirTree Ventures, 2020

- The reluctant founder, The Spinoff, 2019

- In conversation with Sam Gribben, Sunrise, 2019

- In the beginning, we had no idea: on the birth and growth of Trade Me, The Spinoff, 2019

- A conversation with Adela May, Startup Grind, Wellington, 2018

- Open The Pod Bay Doors Podcast with Ian Gardiner, Australian Innovation Bay, 2018

- How to make a startup business last, Sunday Morning, Radio New Zealand, 2017

- Business is Boring Podcast with Simon Pound, The Spinoff, 2017

- Flag the rest & Could the RedPeak design fly? & Social media provides platform for flag design change, Morning Report, Radio New Zealand, 2015

- On being a most blessed geek, Stuff, 2011

- Playing Favourites with Kim Hill, Radio New Zealand, 2010

- Entrepreneurs buy into point-of-sale firm, Stuff, 2010

- Six degrees experiment finds camera owner, NZ Herald, 2009

- Fireside chat with Sam Morgan, Webstock, 2008

- Former Trade Me manager joins Xero, Geekzone, 2007

- Microsoft TechEd Keynote, 2006

- Trade Me Diversifies Into Flats & Flatmates, Scoop, 2001