Diversification protects wealth.

But concentration produces wealth.

There is a massive disparity of possible outcomes from investing in early-stage companies. There is a good chance we will lose all the money invested, and a very small chance that the company will go on to become very valuable and in the process make us look like a genius for choosing to back it in the beginning. It’s nearly impossible to tell for sure in advance which specific opportunities are the likely winners.

In response to this uncertainty, many would-be investors make the mistake of believing they can reduce their exposure to this risk via diversification. That is, spread the money they invest across a portfolio of startup companies, hoping that one of them will be a winner and offset the losses from the others. Or, more colloquially: “don’t put all your eggs in one basket”.

The general theory of diversification is sound, and makes a lot of sense when investing in larger public companies: 1

By diversifying, one loses the chance of having invested solely in the single asset that comes out best, but one also avoids having invested solely in the asset that comes out worst. That is the role of diversification: it narrows the range of possible outcomes.

Importantly, the lower end of that “range of possible outcomes” when we are talking about private early-stage companies is still “we lose all the money we invested”.

The term diworsification was first coined by Peter Lynch.2 He was describing a situation where risk is already very low, so adding additional assets to a portfolio doesn’t help. The same logic applies when risk is already very high.

Diversification protects wealth. But concentration produces wealth.

What does diversification cost?

Imagine we have $10,000 to invest.

We could diversify by investing $1,000 into ten different ventures and hoping that at least one of them does well. Or, we could focus by investing the full $10,000 into a single venture and hoping that it does well.

Let’s consider the extreme ends of the return spectrum for these two alternative approaches…

Remember, the odds of picking a winner in either case are very low, but the reward if we do can be spectacular - for the sake of this example let’s assume that each $1 invested could, just a few years later, be worth $3,000 or more. This is, very roughly, the return on the original $100,000 that investors put into Trade Me in 1999 when the company was sold in 2006.

Q: What happens in our two scenarios in the best case - i.e. we pick a winner?

If we diversified, we lose our money on nine of the ventures, but the $1,000 invested in the winner becomes $3 million. That’s not a bad result by any measure.

However, if we didn’t diversify and instead invested the full $10,000, the return becomes $30 million!

Q: What happens in the worst case - i.e. if we don’t pick a winner?

Remember, this is by far the most likely outcome. And the maths is easy: in both cases we lose all our money.

While a portfolio approach gives us more chances to pick a winner, the opportunity price we pay for that is a 10x reduction in the best-case return, without any improvement on the worst-case outcome. The bigger the portfolio the lower the best-case return.

Of course, those are only the two extremes. What about the possible outcomes in between? It’s tempting to think these would be more common, by assuming that the possible returns from an early-stage investment are a normal distribution with the median being positive. Sadly that’s not the reality.

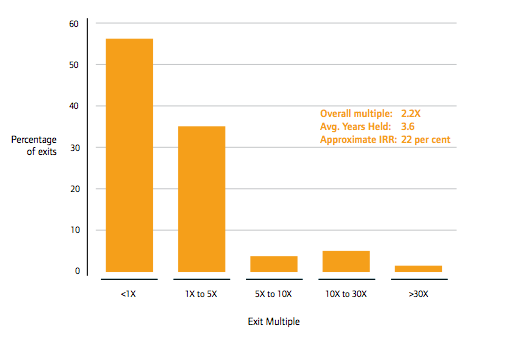

On a percentage basis, most early-stage investments result in the investor losing money. The big wins are the very rare exception.

If we assume no selection bias and a large enough portfolio, then the overall expected return is a little over $2 for every $1 invested.

In practice, the outcome for any individual investor is much more binary than most people who take this approach realise.

Each investment we make is a discrete event - a separate spin of the roulette wheel. We can bet on the same number all night, and it doesn’t matter how many times we play it doesn’t make it any more or less likely that we will hit the jackpot.

If we do pick a winner then our return is a simple function of how many other companies we have in the portfolio (more companies = lower return). If we don’t pick a winner then the number of losers we picked is irrelevant.

We win by investing in the best companies, not the most companies.

How do we choose?

The common mythology says that one in ten startup investments is a big winner. All we have to do is randomly pick ten companies then sit back and wait for one of them to win, right?

Sadly, no.

There are two big assumptions in the logic above that don’t stand up to much scrutiny when we look at the portfolio of any individual early-stage investor.

The first, and more difficult, is the “no selection bias” assumption.

This is all about our judgement in picking great companies before they are obviously great.

Are all of the companies we choose to invest in potential big winners? Or, do we have a blind spot, which means that each investment is possibly flawed in the same way?

One common but often overlooked source of selection bias is our source of investments - what some investors call “deal flow” or “pipeline”.

When we’re screening public companies, we can buy shares in any company we choose to invest in, if we’re so inclined. Shares in these companies are traded everyday. With private early-stage companies it’s not so simple. The best companies (i.e. those most likely to be big winners) are generally able to pick their investors. If we wait for companies to pitch to us, or insist on harsh investor-friendly terms, or want to invest passively from the sidelines rather than taking an active role in helping, then we probably have a selection bias - i.e. we only invest in more desperate companies.

This is one of the reasons why I advocate a founder-centric approach.

Those who take a portfolio approach often invest via syndicates or so-called “angel” groups. It is common for everybody in the syndicate to assume somebody else has done the work to validate the potential of the investment, meaning nobody has.

It only takes a small amount of poor judgement to introduce a potentially fatal selection bias to an entire portfolio.

This is accentuated when we’re not even trying - either investing in “hot” deals just because others have invested on the nearly-always incorrect assumption that they have good judgement, or investing without ever asking for details of what we’re putting our money into.

If we blindfold ourselves and throw darts we can’t really complain if none of them hits the bullseye!

The second more easily dismissed assumption is the “large enough portfolio” assumption.

Perhaps if we could build up a portfolio of hundreds or thousands of early-stage companies then our return might be what the theory suggests it should be on average.

That’s not practical for most early-stage funds, let alone individual investors. We continue to stubbornly believe, despite lots of evidence to the contrary, that there is a shortage of capital in New Zealand, when the reality is there are simply not that many high-quality investment-ready companies.

In either case, as we saw above, the larger the portfolio the lower the return if we do happen to pick a winner. Investors who build really big portfolios are backing themselves to pick multiple big winners, or one exceptionally big winner (a.k.a. “a moon shot”).

Diversification == Lack of focus

The last thing to consider is much more subjective.

For most ventures, removing a capital constraint only uncovers an execution constraint. The best early-stage investors understand the money they invest is important as a ticket to the game, but the advice they give and the work they do to help the founders progress the business is much more impactful.

The question is not only how much money we’re willing to invest, but also how much time. For most early-stage investors, myself included, that quickly becomes the limiting factor.

Taking a portfolio approach means that both time and money are spread more thinly and much less likely to contribute to the success of the ventures.

If you want to be an early-stage investor, put all your eggs in one carefully selected basket, then work hard to make that basket a good choice.

You may or may not pick a winner - remember these are startups we’re talking about so the odds of success are stacked against you either way. But if you’re going to take the risk, you may as well set yourself up to enjoy the full up-side if you do get lucky.

-

Diversification (finance), Wikipedia. ↩︎

-

Diworsification, Investopedia. ↩︎