Money is like gas in the car — you need to pay attention or you’ll end up on the side of the road — but a well-lived life is not a tour of gas stations

By far the most common question I am asked by founders is not how to grow a successful business or build a great team, but how to raise more capital. It often feels like getting investment has become an end in itself.

When we own a rapidly growing company, and believe it’s going to be worth much more in the future, diluting that ownership by raising more capital can seem irrational. Three things need to be true before it makes sense:

First, we have some momentum, even if the numbers are small. If we don’t already have some wind in our sails then it’s hard work to convince anybody to invest. Better to spend that time on more important things, like getting the boat moving.

Secondly, we know exactly how we will spend the money. Assuming the answer is (as it almost always is) hiring more people then we should be specific about the roles we need to fill and how much it will cost to fill them, including the total cost of having a larger team beyond just the salary costs – recruitment fees, equipment, office costs or the additional costs of running a useful remote team, and so on – plus the harder-to-quantify distractions that come from having more people involved.

Finally, we can clearly describe the next milestone. And maybe the one after that. When we don’t know where we’re going then any road leads us there.1 But when we take investment we need to pick a path and narrow our focus.

Begin with the end in mind

Before we decide how to fund our startup we should be clear about what kind of business we hope to build, and who is the best partner to help us achieve that outcome. The first question is whether we should raise outside capital at all.

In simple terms there are three ways to fund an early-stage business:

1. Burn baby, burn!

We can raise as much money as possible, then spend it aggressively in pursuit of revenue. This means painting a big picture for new investors. Before they give us money they need to believe there is a chance they will eventually get a much larger amount back. That requires us to continue to grow rapidly, and (at some point) achieve liquidity for them by selling or floating the business. It’s a one-way street. It’s critical that we commit to it. Once we’ve taken investment we can’t take our foot off the accelerator.2 We have to cope with the uncertainty. Perhaps there won’t be as many customers as we think, or perhaps it will take us longer than we thought to convince them to buy, or maybe it will be much harder than we expected to build the team we need to help us get there.

Either way, we might spend all the money we raised. Unless we can continue to build momentum and find a way to tell an even bigger story, it will be difficult to raise more money when required. Flipping from a high-cost model to a low-cost model isn’t fun when we’ve hired people we like. Growing quickly is hard. Shrinking quickly is harder. On the other hand, if we’re successful then we can end up owning a share of a business that is worth much more than we could have created on our own.

2. Live on two-minute noodles

Or we can keep our costs as low as possible for as long as possible, and try to quickly get to a cash-flow-positive position. Maybe we can fund those early stages ourselves from savings, or find a patient benefactor who is prepared to invest a modest amount of capital. Either way, we need to make a small amount of cash go a long way. Ideally all the way to a profitable business.

We don’t always have this luxury. In the meantime, perhaps somebody else will come along with more resources (see “Burn baby, burn!”, above) and grab all of the customers before we can get to them. Or maybe it requires more investment (both time and money) than we have? Of course, if it does work, we are left owning most of a business that’s paying for itself, and generating cash. That puts us in a strong position to talk to potential investors, to reinvest in growing the business further ourselves, or to simply sit back and enjoy the profits.

3. Juggle paid work

Alternatively we can use revenue from consulting or other part-time work to fund our own ideas. The potential risk is that we find it difficult to wean ourselves off our dependence on the comfortable salary our regular work provides. It can be hard to say “no” to work when it is available, even when it absorbs all of the time we have. As Nassim Nicholas Taleb put it, “The three most harmful addictions are heroin, carbohydrates, and a monthly salary.”

Or perhaps we struggle to find enough paid work to cover the costs of working on our own ideas. If we can find the right balance, though, this hybrid approach is a great way to fund a business without having to constantly scrimp and save and do everything on the cheap, and all without having to raise money from needy external investors.

There are examples of great companies that have taken each of these approaches, so it’s not a matter of saying which is best. We need to be careful whose advice we take. Anybody who has been successful in the past usually recommends the approach that worked for them. At Southgate Labs we did a mixture of consulting and product work. At Timely, we were very deliberate about how we spent a small amount of capital. At Xero and, once we had venture investors on board, also at Vend, we spent all that we had trying to get as big as possible as fast as possible.

The important thing is to choose. Don’t get stuck halfway between these options, taking on investment (with the associated expectations that brings) but not raising enough money to really go hard, or treating the venture as a side hustle while also taking on external shareholders. And never forget: how we fund our venture or how much capital we raise is ultimately irrelevant unless we make something people want and can sell it to them for less than it costs us to make it.

Investor motives

Once we have decided that raising capital is what we want, the next most important question to ask is: “who?”

A common mistake founders make is assuming that all potential investors are homogenous. Instead, understanding exactly what motivates each individual investor allows us to adjust how we present the opportunity to them.

Some investors are attracted by the apparent glamour of early-stage ventures. They like to tell their friends and colleagues that they are involved in something that sounds exciting. They need some recognition for their involvement, even if it’s small.

Some investors are looking for something to spend their time on, and prefer to leverage that investment with a small financial stake. They need a role where they feel they are involved and making a difference.

Some investors simply want to get back more money than they invested, plus some extra for the risk they took. It’s useful to understand what returns they are expecting. They need a forecast that gives them confidence that if things go well an outcome like that is possible.3

Some investors who manage a fund on behalf of others are compensated based on the size of the fund and the overall capital gain they produce for their funders. For example, a general partner in a venture capital fund will typically receive 2% + 20%, meaning they are paid 2% of the total value of the fund they manage every year, to cover their fixed costs, plus 20% of any gains.4 They need to be convinced that we have a chance of knocking it out of the park – because they are investing in a portfolio of companies alongside ours, there is not much difference for them between a mild success and a complete failure, so they will expect us to be swinging for the fences.

Finally, some investors who manage a fund on behalf of others are compensated based on the current value of those investments. For example, a hedge fund will typically pay managers an annual bonus based on the increase in value. This effectively means they buy the shares again every year. They need to believe that we can steadily increase the value of the business over time and avoid any nasty shocks which could cause the value to drop from one year to the next.

Founder–investor fit

Investors are like a puppy for Christmas. We can’t just hand them back when we get tired of them or ignore them when they need attention. So choosing the right investors is a critical decision. Often, as a venture grows, there is a complete mismatch between the motivations of founders and those of investors. We need to decide what kind of investor is the best fit for the stage we’re at and our own ambitions for the future.

If we’re just getting started and need to raise a small amount of capital to cover costs while we explore the opportunity, then we’ll probably struggle to get larger investors excited, given they generally prefer to invest bigger amounts once there is an obvious way that this money can be used to remove constraints and accelerate the growth of the business. More than this, it can sometimes be distorting, even toxic, to get a high-profile investor on board in the first round – in the next round other investors will take the lead from them, and if they choose not to continue investing, for any reason, then we’ll likely struggle to explain to others why they should think differently.

Conversely, once we’re ready for larger amounts of capital to help accelerate, then it’s a waste of time to continue pitching to investors who are mostly interested in the story or contributing their time, but who normally don’t write big cheques. Or if our goal is to create a business that will pay a good salary to founders and maybe a few employees, then we’re creating a future headache for ourselves if we raise any money from financial investors who are driven by a return. It’s best to have this conversation explicitly with potential investors.

Too many founders start investment discussions with questions like “how much?” or “at what valuation?” or even “how quickly?” These are the wrong questions. The best founders choose their investors carefully, looking beyond the size of the cheque to consider what else potential investors bring to the table. The ideal investor for the next stage isn’t necessarily the one with the deepest pockets – it’s the one whose experience, network, and approach align with what the venture needs to reach its next milestone. Their track record from previous ventures tells the real story: do they consistently add more value than they capture for themselves?

The roundabout

Once we’ve chosen our ideal investors and convinced them to join the team, the final step is to agree terms everybody is happy with. We need to make sure investors are putting enough cash in, and owning enough of a percentage in return, so that they care about the venture and will also invest their time and energy and networks.

A lead investor will help to shape a round. Some will be happy to go alone. Others will prefer to be part of a group, and can make introductions. The important thing is to start with the larger investors, then ask them to help find smaller investors to take what is remaining. Too often I see founders do this in the reverse order. It’s nearly always a mistake. A lead investor should be someone who has the willingness to go first and fill a sizeable portion of the current round as well as capacity to invest in subsequent rounds. Ideally they should also be able to make introductions to other larger investors in the future.

A lead investor will also help to set the valuation. It might sound simplistic, but I like a market solution to this otherwise gnarly problem. The price is whatever an investor will offer and whatever founders will stomach, and hopefully there is some overlap between those two. These are two rules of thumb I use:

-

Plan to raise enough to cover 18–24 months’ worth of expenses, based on a well-documented and easily communicated plan that estimates what these are likely to be.

-

Expect to dilute between 20–30% per round, so that there is enough equity available to new investors to ensure we have their attention into the future.

Given those constraints we can triangulate a valuation range to start the discussion with. Sometimes founders are tempted to hack that formula by raising more frequent smaller amounts, or using convertible notes to avoid having difficult valuation conversations. But when we do the maths retrospectively it nearly always still ends up the same (or worse).

It gets more complicated if we already have customers and revenue and a growth trajectory, since that gives some basis for a valuation based on fundamentals. For example, investors will sometimes look at a multiple of annualised revenue when considering the valuation of a SaaS business. However, at an early stage when the numbers are small that often ends up being in the range I mentioned above anyway.

Metrics that demonstrate momentum and market validation stick in the mind of the person receiving the pitch much more effectively than promises, so it’s tempting to just share those and let potential investors extrapolate. But numbers can easily ruin a story, so we need to make sure all of the numbers are good, or at least be prepared to explain those that are not.

Try not to get bogged down in this. At the end of the day neither founders or investors win because they eked the last percentage point of ownership or dilution out of a funding round negotiation. We win by working together to build a fast-growing, arse-kicking, name-taking business. In the not-too-distant future whatever valuation is used at the outset is likely to either look way too high (because the company is dead and therefore worthless) or way too low (because it became a big success). It doesn’t make sense to die in a ditch over terms that probably won’t matter down the track.

The real question isn’t how much we raise or at what price – it’s whether we’re building something worth funding in the first place.

-

This quote is a simplified summary of a conversation between Alice and the Cheshire Cat from Lewis Carroll’s Alice’s Adventures in Wonderland:

“Would you tell me, please, which way I ought to go from here?”

“That depends a good deal on where you want to get to,” said the Cat.

“I don’t much care where—” said Alice.

“Then it doesn’t matter which way you go,” said the Cat.

“—so long as I get SOMEWHERE,” Alice added as an explanation.

“Oh, you’re sure to do that,” said the Cat, “if you only walk long enough.”It’s possibly referencing an even older quote from the Ancient Roman philosopher Seneca:

↩︎If one does not know to which port one is sailing, no wind is favourable.

-

Surviving The Sharks, Sacha Judd at Microsoft TechEd, 2014. ↩︎

-

We should be cautious when investors ask for a multi-year forecast, before we have enough data to make good assumptions. Matt Mireles said it best:

↩︎One of the red flags I look for is seed investors that want me to make things up and lie to them. This typically manifests itself in the form of long-term financial projections. “What will your sales be five years from now?” I have no fucking clue, and if you’re asking me that question, neither do you.

-

See Venture Fund Economics by Fred Wilson, August 2008. ↩︎

Related Essays

Diworsification

A portfolio approach to early-stage venture investment doesn’t really help and probably hurts.

How to Pitch

We realised that the most effective investment pitches all start with the same two words…

Pining for the Fjords

Be honest: Can we get to the next milestone with the resources we have?

Anything vs Everything

How do we choose what to focus on, and have the conviction to say “no” to everything else?

M3: The Metrics Maturity Model

Use these simple steps to improve how we measure and report our progress.

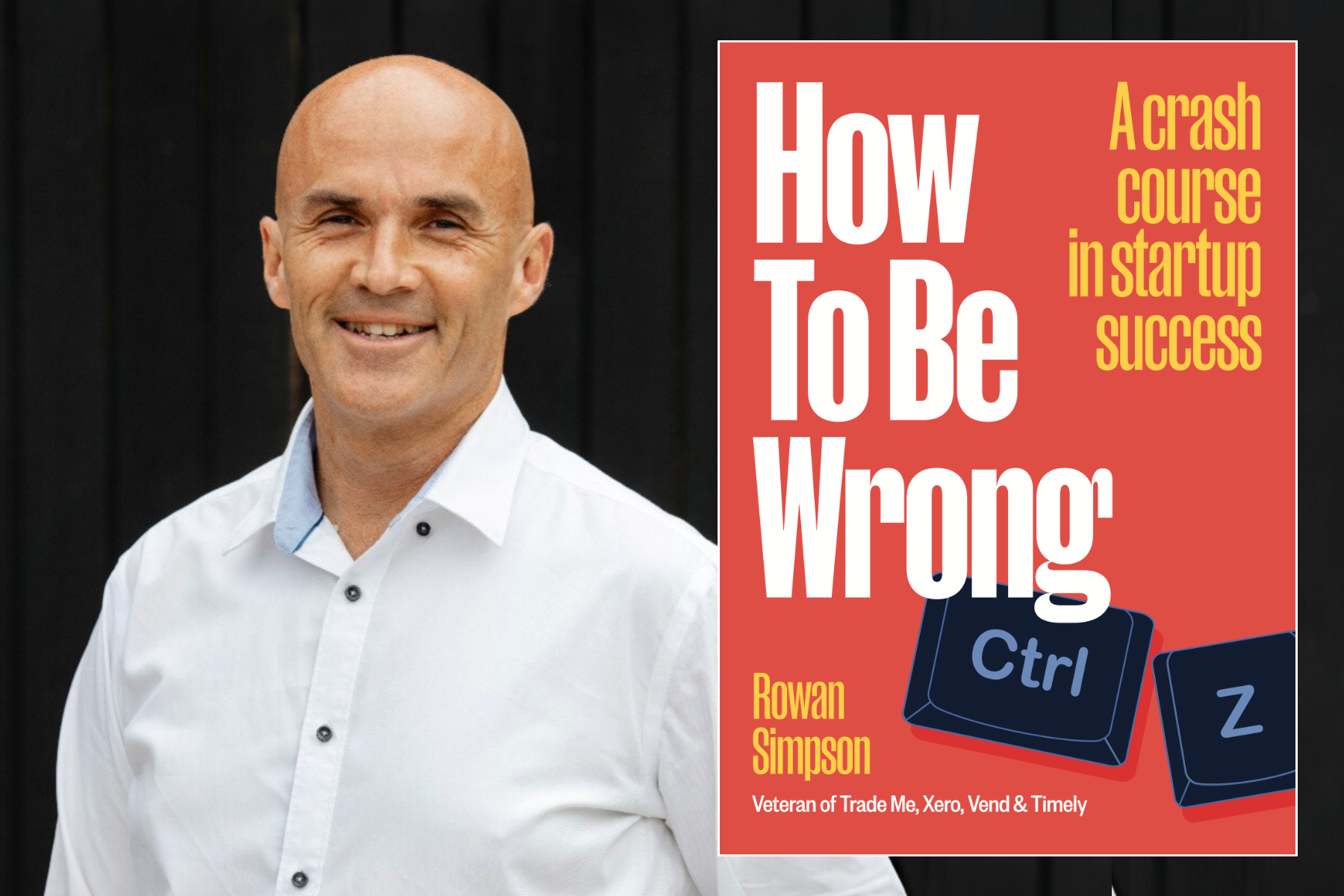

Buy the book